Planning for retirement is important. It is crucial to understand how your money is being used. There are a few things that you can do to make your money last as long and as well as ensure it stays there. You can set goals and invest. You'll feel secure knowing you have a plan in place to manage your finances.

Social Security

Your Social Security benefits are important when you plan for retirement. In most cases, you'll be eligible to collect benefits as early as 62. Not claiming benefits early enough could result in a substantial reduction in your benefits. This is especially true in women, who tend live longer than men and make less.

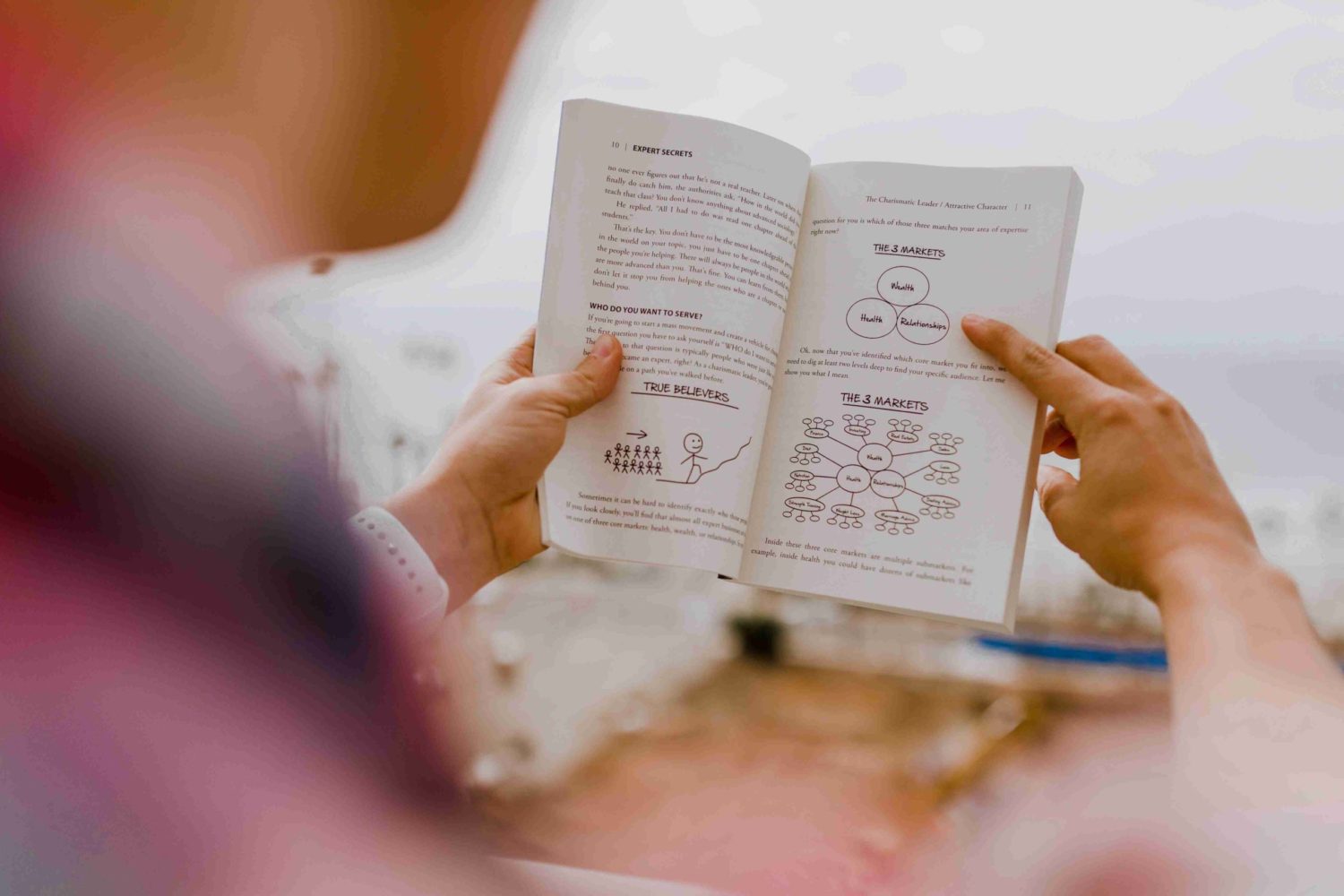

Investing

Your investments should be diversified as you approach retirement to minimize risk and maximize return. Diversification reduces the risk of market volatility and inflation, and smoothes returns. Diversification could allow you to retire sooner and have a better life. Before making any retirement plans, consult a financial advisor.

Long-term care insurance

Long-term care insurance is an important part of retirement planning. Because long-term costs are increasing, it's essential to have adequate coverage. You should also look for policies that include inflation protection.

Save for retirement

Planning for retirement can be a crucial part of financial planning. It is crucial to start planning for retirement years before you actually need it. This will help you plan more firmly and calmly when the time comes. Social Security may help with some expenses during retirement but it is not likely to cover all. It is important to consider other income sources, such as annuities, pensions, and proceeds from the sale or rental of your home.

Investing in a traditional IRA (or 401(k),)

Individual retirement accounts (or IRAs) allow the participant to select from a variety of investments. This type retirement plan has no investment guarantees and the income you receive will depend on the returns. Examples of such plans include 401(k), 403(b), 457, and profit-sharing plans. Diversification is a common strategy used in these retirement plans. Diversification protects you against the loss of a single security by spreading your principal to different markets or sectors.

Home equity

You can increase your retirement savings by investing in home equity. It comes with some risks. Your home may be lost if your loan is not paid on time. Another option is downsizing your home and renting it out.

Investing in a 401(k)

For retirement savings, you can make an investment in a company 401(k). Many employers offer this plan, and you can join at any time. Employers will match any amount that you invest. Ask your human resources department about the plan for your company.

Investing In A Traditional IRA

If you are looking to save money for your retirement, you should consider investing in a traditional IRA. You can make pre-tax contributions to this account and your money grows in a tax-deferred manner. You will be subject to income tax when you withdraw the funds. You can open a traditional IRA at a bank or brokerage. These institutions offer savings accounts as well as certificates of deposits, which could be a good option to build your retirement fund.